Leveraging Technology to Maximize Returns: A Guide to Business Stocks

Leveraging Technology to Maximize Returns: A Guide to Business Stocks. In the ever-evolving world of investment, technology has become a pivotal factor in identifying and capitalizing on high-potential business stocks. From algorithmic trading to advanced analytics and real-time data feeds, technological innovations are transforming how investors approach stock markets. This post explores how technology can be utilized to enhance stock market returns, highlighting key tools, strategies, and considerations.

The Role of Technology in Modern Investing

1. The Evolution of Trading Platforms

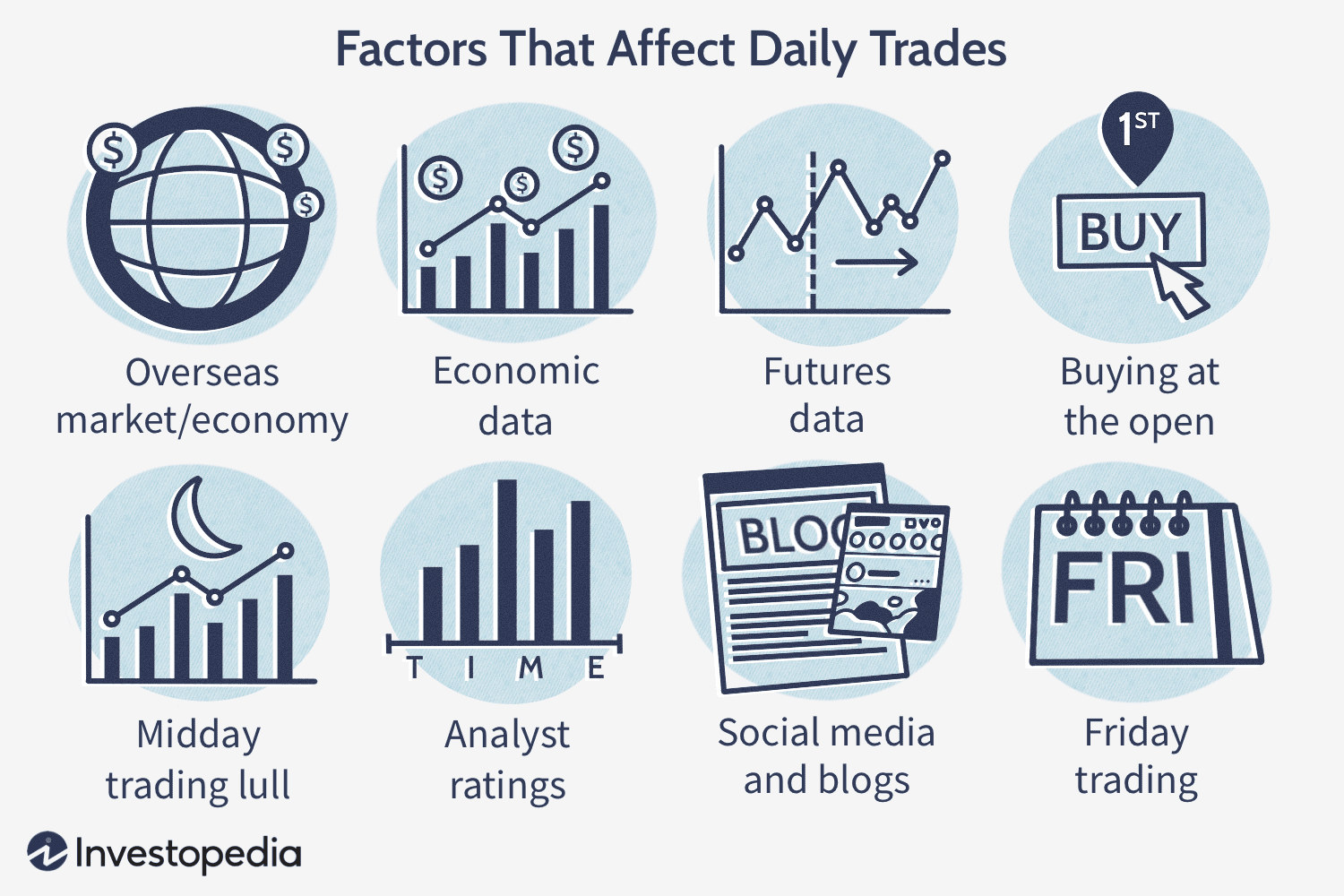

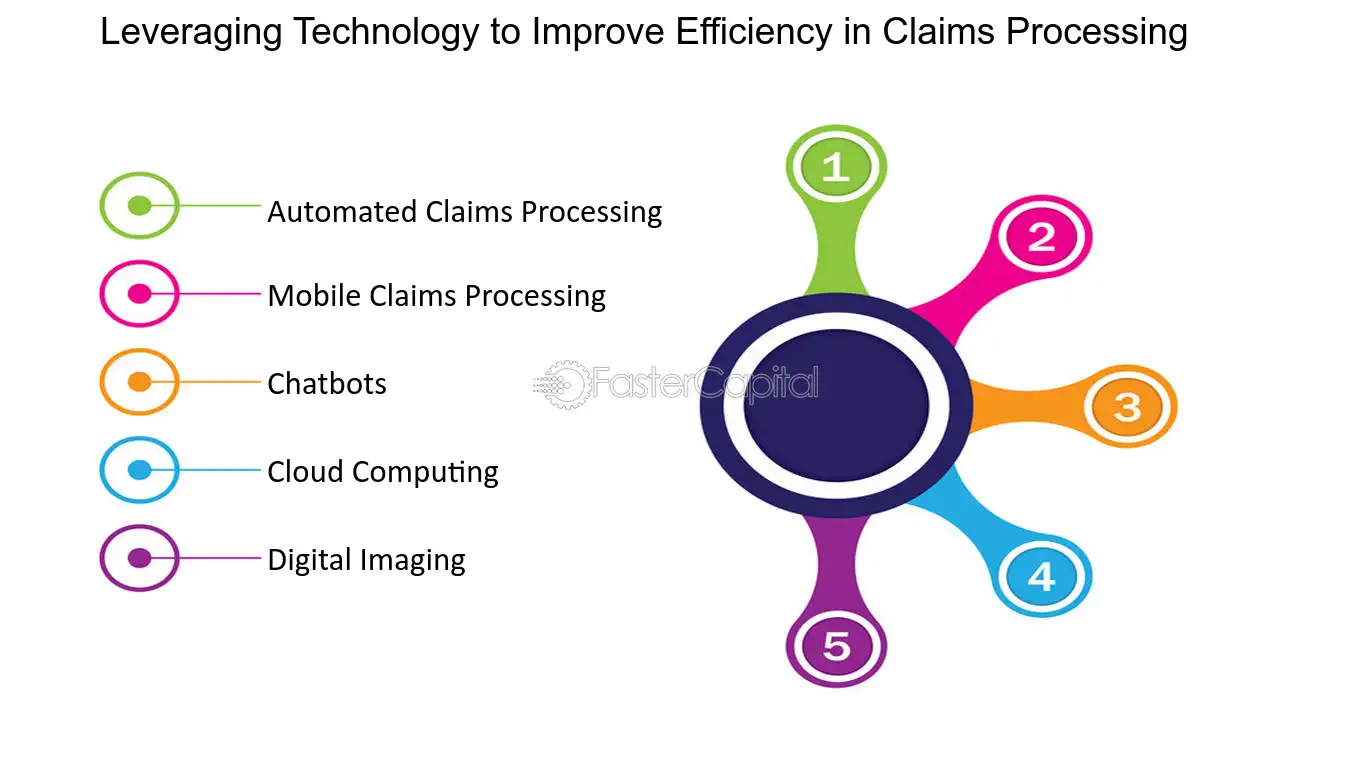

Traditional stock trading, which once relied on human brokers and slow, manual processes, has been revolutionized by technology. Modern trading platforms offer a suite of advanced features designed to help investors make informed decisions and execute trades efficiently. Key advancements include:

- Real-Time Market Data: Access to up-to-the-minute stock prices, news, and financial reports allows investors to react swiftly to market changes.

- Algorithmic Trading: Automated trading systems use algorithms to execute trades based on pre-set criteria, removing emotional biases and enhancing decision-making speed.

- Mobile Trading: Mobile apps enable investors to monitor their portfolios, execute trades, and receive alerts from anywhere, providing greater flexibility and control.

These innovations make it easier for both amateur and professional investors to navigate complex markets and identify lucrative opportunities.

2. Data Analytics and Predictive Modeling

Data analytics has become an essential tool for evaluating business stocks. By leveraging big data and machine learning, investors can uncover patterns and trends that are not immediately apparent through traditional analysis. Key aspects include:

- Sentiment Analysis: Using natural language processing (NLP) to analyze news articles, social media posts, and other textual data can provide insights into market sentiment and potential stock movements.

- Predictive Analytics: Advanced algorithms forecast future stock performance based on historical data, market trends, and other variables, allowing investors to anticipate potential gains or losses.

- Risk Assessment: Tools that evaluate financial health, market volatility, and other risk factors help investors make more informed decisions and manage their portfolios more effectively.

Data-driven strategies enable investors to make evidence-based decisions, reducing reliance on intuition and improving overall investment performance.

Strategies for Maximizing Returns

1. High-Frequency Trading (HFT)

High-frequency trading employs sophisticated algorithms to execute a large number of orders at extremely high speeds. By capitalizing on minute price fluctuations, HFT firms can generate significant profits. While this strategy requires substantial technological infrastructure and expertise, it illustrates how technology can be leveraged for competitive advantage in the stock market.

2. Quantitative Investing

Quantitative investing relies on mathematical models and statistical techniques to identify investment opportunities. By analyzing vast datasets, quantitative funds (or “quant funds”) make data-driven decisions that can outperform traditional investment strategies. This approach involves:

- Developing Proprietary Models: Using historical data and sophisticated algorithms to create models that predict stock performance.

- Backtesting: Testing models against historical data to validate their effectiveness before applying them to live trading.

- Optimization: Continuously refining models and strategies based on new data and market conditions.

Quantitative investing leverages technology to systematically evaluate and invest in business stocks, often leading to superior returns.

3. Leveraging Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are reshaping the investment landscape by enhancing predictive capabilities and decision-making processes. Key applications include:

- Portfolio Management: AI-driven portfolio management tools analyze individual investor preferences, risk tolerance, and market conditions to recommend optimal investment strategies.

- Stock Screening: ML algorithms can scan and analyze thousands of stocks to identify those with the best potential for growth, based on a variety of metrics and indicators.

- Fraud Detection: AI systems can detect unusual trading patterns and potential fraud, safeguarding investments and ensuring market integrity.

Integrating AI and ML into investment strategies allows for more precise and adaptive approaches, potentially leading to higher returns.

Considerations and Best Practices

1. Staying Informed and Educated

While technology provides powerful tools, it is essential for investors to stay informed about market conditions, technological advancements, and economic factors. Continuous learning and staying updated on new technologies and investment strategies can enhance decision-making and optimize returns.

2. Risk Management

Technology can enhance investment strategies, but it also introduces new risks. Investors should implement robust risk management practices, such as:

- Diversification: Spreading investments across various asset classes and sectors to mitigate risk.

- Regular Monitoring: Continuously monitoring portfolio performance and making adjustments as needed.

- Setting Limits: Establishing stop-loss orders and other risk management tools to protect against significant losses.

3. Ethical and Regulatory Considerations

As technology advances, so do regulatory frameworks. Investors must stay abreast of regulations governing algorithmic trading, data privacy, and market manipulation. Ethical considerations, such as the responsible use of AI and data, also play a critical role in maintaining market integrity and investor trust.

Conclusion

Technology has profoundly transformed the landscape of stock market investing, offering tools and strategies that can significantly enhance returns. By leveraging real-time data, advanced analytics, AI, and algorithmic trading, investors can make more informed decisions and capitalize on high-potential business stocks. However, it is crucial to balance technological advantages with sound risk management practices, continuous education, and ethical considerations.

As technology continues to evolve, its impact on investing will likely grow, presenting both opportunities and challenges. Embracing these advancements and staying informed will be key to maximizing returns and achieving long-term success in the stock market. Leveraging Technology to Maximize Returns: A Guide to Business Stocks.