Factors to Consider in Stock Exchange

Factors to Consider in Stock Exchange. The stock exchange can be an exciting yet complex environment for both novice and seasoned investors. Understanding the factors that influence stock prices and market trends is essential for making informed decisions. Whether you’re trading stocks, bonds, or other securities, you must be aware of the various factors that impact stock exchange performance.

In this article, we’ll explore the key factors to consider when trading in the stock exchange, ranging from economic indicators to market sentiment. By the end, you’ll have a clearer understanding of what drives the stock market and how you can use this knowledge to make smarter investment choices.

Outline of the Article

- Introduction to the Stock Exchange

- What is a stock exchange?

- How does the stock market work?

- Understanding Economic Indicators

- Inflation rates and their impact

- Interest rates and stock prices

- Company Performance and Fundamentals

- Earnings reports and financial health

- Price-to-earnings (P/E) ratio

- Market Sentiment

- The role of investor psychology

- News and media influence

- Global Events and Geopolitical Factors

- How political events affect the market

- Global economic trends

- Supply and Demand in the Stock Market

- The law of supply and demand

- Market liquidity

- Industry Trends and Sector Performance

- How industries influence stock prices

- Diversifying across sectors

- Technical Analysis in Stock Trading

- Understanding charts and trends

- Key technical indicators

- Regulatory Environment

- Government policies and regulations

- The impact of financial laws

- Technology and Automation in Trading

- The rise of algorithmic trading

- How technology influences stock prices

- Risk Management Strategies

- Importance of diversification

- Hedging techniques

- Market Volatility and How to Handle It

- What causes market volatility?

- Strategies to minimize risk

- The Role of Dividends in Stock Investments

- Understanding dividend yields

- How dividends impact stock prices

- Investor’s Time Horizon

- Short-term vs. long-term investing

- Time horizon’s effect on risk and returns

- Conclusion and Summary of Key Points

- Recap of the factors affecting the stock exchange

- Importance of staying informed

1. Introduction to the Stock Exchange

Before diving into the various factors that affect the stock market, it’s important to understand what a stock exchange is and how it functions. A stock exchange is a marketplace where buyers and sellers trade shares of publicly listed companies. The exchange facilitates transactions between investors and ensures that trades are conducted fairly and transparently.

The stock market operates based on supply and demand. When demand for a stock increases, its price goes up, and when demand falls, its price decreases. However, the dynamics of the market are influenced by multiple factors, including economic conditions, company performance, and global events.

2. Understanding Economic Indicators

One of the most important factors influencing stock prices is economic indicators. These are metrics used to gauge the overall health of the economy. Two key indicators to keep an eye on are inflation rates and interest rates.

Inflation Rates and Their Impact

Inflation measures the rate at which the general level of prices for goods and services is rising. When inflation is high, purchasing power decreases, and this often negatively impacts stock prices. Investors may become cautious, leading to lower demand for stocks.

Interest Rates and Stock Prices

Interest rates, set by central banks, influence borrowing costs for businesses and consumers. When interest rates rise, companies may face higher expenses, which can reduce profits and affect stock prices. On the other hand, low interest rates can stimulate economic growth, boosting the stock market.

3. Company Performance and Fundamentals

The performance of a company plays a crucial role in determining its stock price. The Earnings reports and financial health indicators like the price-to-earnings (P/E) ratio give investors insights into a company’s profitability.

Earnings Reports and Financial Health

Earnings reports are released quarterly and provide details about a company’s revenues, profits, and other financial metrics. Positive earnings can drive stock prices higher, while disappointing earnings may lead to a sell-off.

Price-to-Earnings (P/E) Ratio

The P/E ratio helps investors determine whether a stock is overvalued or undervalued. A high P/E ratio may indicate that a stock is overpriced, while a low P/E ratio could suggest that it’s a bargain.

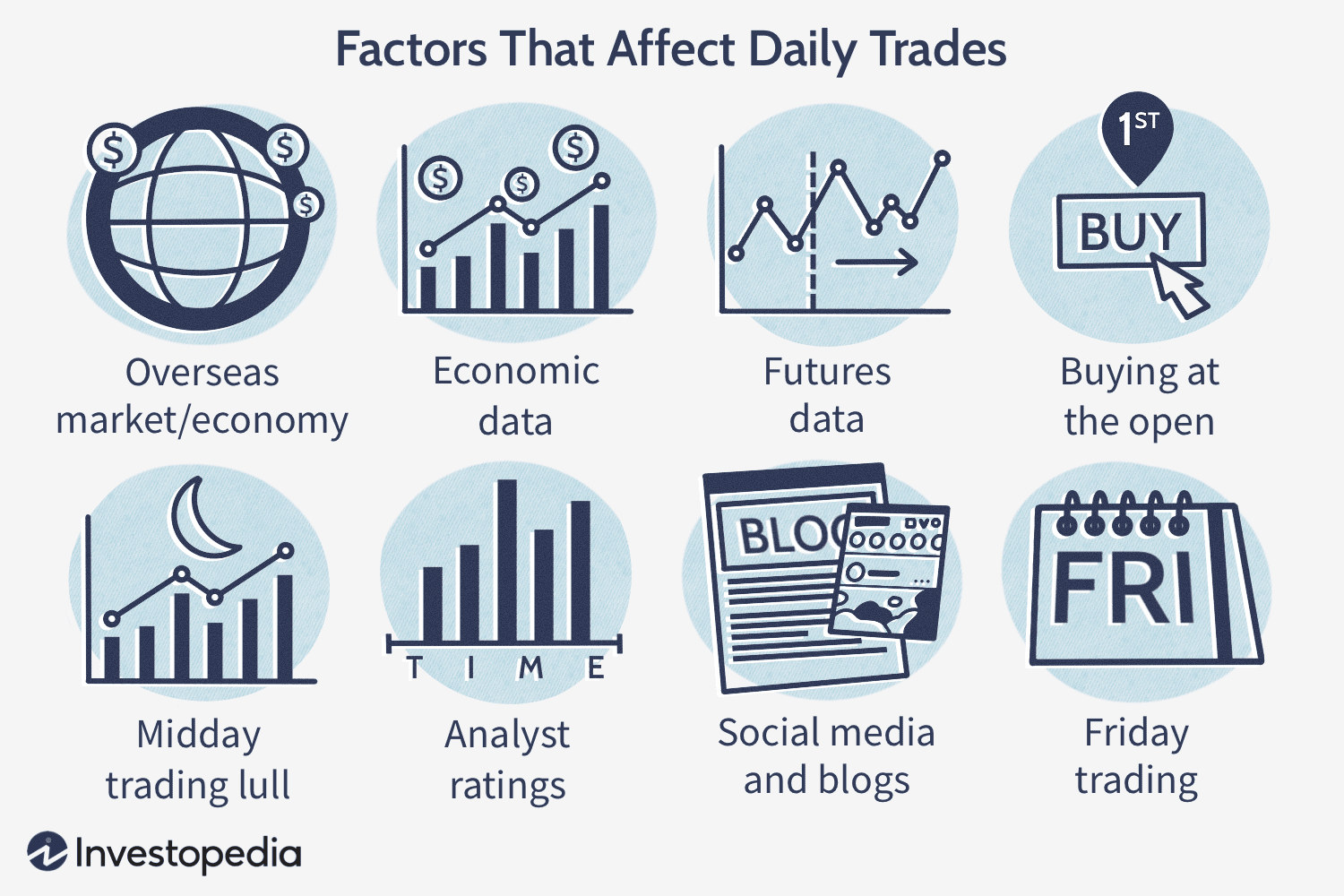

4. Market Sentiment

Market sentiment refers to the overall mood or attitude of investors toward the market. It’s largely driven by investor psychology and external factors like news and media coverage.

The Role of Investor Psychology

When investors are optimistic, they tend to buy more stocks, driving prices up. Conversely, fear or uncertainty can cause investors to sell, leading to a decline in stock prices. Emotions such as greed and fear play a huge role in market movements.

News and Media Influence

Media outlets have a powerful impact on market sentiment. Positive news about a company or the economy can trigger buying, while negative news can lead to panic selling. Investors need to stay informed but also avoid making decisions based solely on media reports.

5. Global Events and Geopolitical Factors

Political events and international developments significantly influence the stock exchange. Geopolitical tensions, trade wars, and global economic trends can affect investor confidence and market stability.

How Political Events Affect the Market

Elections, government policies, and international relations can create uncertainty in the market. For example, political instability or trade tariffs can reduce investor confidence and lead to a market downturn.

Global Economic Trends

The global economy is interconnected. Events such as oil price fluctuations, changes in interest rates by major central banks, and economic crises in other countries can have a ripple effect on stock markets worldwide.

6. Supply and Demand in the Stock Market

The basic principles of supply and demand also apply to the stock exchange. When there are more buyers than sellers for a stock, the price rises, and when there are more sellers than buyers, the price drops.

The Law of Supply and Demand

Understanding how supply and demand influence stock prices is essential for making trading decisions. High demand for a stock generally indicates a positive outlook for the company, while oversupply suggests lower investor interest.

Market Liquidity

Liquidity refers to how easily a stock can be bought or sold without affecting its price. Highly liquid stocks tend to have smaller price fluctuations, making them less risky for investors.

7. Industry Trends and Sector Performance

Different sectors of the economy perform better at different times. Being aware of industry trends can help you spot opportunities in the stock market.

How Industries Influence Stock Prices

For example, technology stocks may perform well during periods of innovation, while energy stocks may thrive during times of rising oil prices. Sector performance is often influenced by external factors, such as regulatory changes and consumer demand.

Diversifying Across Sectors

Investors can reduce risk by diversifying their portfolios across multiple sectors. This strategy helps mitigate losses in one sector by balancing them with gains in another.

8. Technical Analysis in Stock Trading

While fundamental analysis looks at company performance, technical analysis focuses on stock price trends and patterns to make investment decisions.

Understanding Charts and Trends

Charts showing price movements can help investors predict future stock performance. For example, candlestick charts provide insights into short-term price action and trends.

Key Technical Indicators

Indicators like the moving average and relative strength index (RSI) can help investors determine whether a stock is overbought or oversold. These tools are valuable for identifying entry and exit points.

9. Regulatory Environment

Government policies and regulations play a significant role in the stock exchange. Changes in financial laws, tax policies, and trade agreements can all influence stock prices.

Government Policies and Regulations

For example, stricter regulations on a particular industry may hurt stock prices, while deregulation could lead to a surge in investor interest.

The Impact of Financial Laws

New laws and regulations often affect how companies operate and can have long-term consequences on stock prices, particularly for sectors like finance and healthcare.

10. Technology and Automation in Trading

The rise of algorithmic trading and technological advancements have revolutionized the stock market. High-frequency trading algorithms can execute orders at lightning speed, affecting market liquidity and prices.

The Rise of Algorithmic Trading

Algorithmic trading uses computer programs to trade large volumes of stocks automatically. This has increased efficiency but also contributed to flash crashes, where markets plummet rapidly due to a glitch in trading algorithms.

How Technology Influences Stock Prices

Technology has not only made trading more accessible but also introduced new risks. Artificial intelligence and machine learning are increasingly being used to analyze market data and make predictions, potentially influencing stock prices.