What You Must Know About Crypto Trading According to Insurance

What You Must Know About Crypto Trading According to Insurance. Cryptocurrency trading has rapidly evolved into a significant financial market, attracting investors with the potential for substantial returns. However, with high rewards come high risks. This is where insurance comes into play, providing a safety net against unforeseen circumstances. Here’s a detailed overview of what you must know about crypto trading from an insurance perspective.

Understanding Cryptocurrency Trading

Definition and Basics

Cryptocurrency trading involves buying and selling digital assets through various exchanges. Unlike traditional markets, the crypto market operates 24/7, providing continuous trading opportunities. Cryptocurrencies like Bitcoin, Ethereum, and numerous altcoins offer traders a wide range of options.

Market Volatility

The crypto market is notoriously volatile, with prices capable of swinging dramatically within short periods. This volatility can lead to significant profits but also substantial losses, making risk management crucial for traders.

The Role of Insurance in Crypto Trading

Mitigating Risks

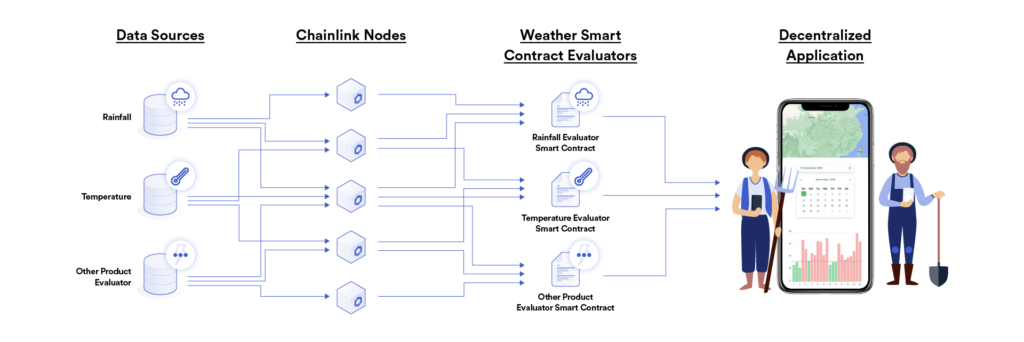

Insurance in crypto trading is designed to mitigate various risks associated with the market. These include hacking, fraud, and operational failures. Given the decentralized and digital nature of cryptocurrencies, they are susceptible to cyberattacks and technical issues, making insurance a vital aspect of trading.

Types of Insurance Coverage

- Custody Insurance: This type of insurance protects against the loss or theft of cryptocurrencies held by a third-party custodian. Custody solutions are often provided by exchanges or specialized firms, and insurance ensures that assets are protected in case of security breaches.

- Cyber Insurance: Cyber insurance covers losses from cyberattacks, including data breaches and hacking incidents. This is particularly important for exchanges and trading platforms that are frequent targets of cybercriminals.

- Crime Insurance: Crime insurance provides coverage for losses resulting from criminal activities such as fraud, theft, and employee dishonesty. Given the high-value transactions in crypto trading, this insurance is crucial for safeguarding assets.

- Directors and Officers (D&O) Insurance: D&O insurance protects the personal assets of company executives in case of lawsuits related to their managerial decisions. For crypto companies, regulatory compliance and legal challenges are significant concerns, making D&O insurance essential.

Key Considerations for Crypto Insurance

Assessing the Insurer’s Credibility

When choosing an insurance provider, it’s essential to assess their credibility and experience in the crypto industry. Look for insurers with a strong track record and understanding of the unique risks associated with digital assets.

Coverage Limits and Exclusions

Understand the coverage limits and exclusions of your policy. Some policies might have high deductibles or exclude certain types of losses, such as those resulting from regulatory changes or market volatility. Ensure that the policy aligns with your specific risk profile and trading activities.

Premium Costs

Insurance premiums can vary significantly based on the level of coverage and the perceived risk. Compare quotes from multiple insurers to find a policy that offers comprehensive protection at a reasonable cost. Keep in mind that cheaper premiums might come with higher deductibles or limited coverage.

Policy Terms and Conditions

Carefully review the terms and conditions of the policy. Pay attention to clauses related to claims procedures, coverage triggers, and any obligations you must fulfill to maintain coverage. Understanding these details can prevent disputes and ensure smooth claims processing.

The Importance of Comprehensive Risk Management

Diversification

Diversification is a fundamental risk management strategy in crypto trading. Spread your investments across different cryptocurrencies to minimize the impact of a single asset’s poor performance on your overall portfolio.

Security Measures

Implement robust security measures to protect your digital assets. Use hardware wallets for long-term storage, enable two-factor authentication on trading accounts, and regularly update security protocols. These measures can significantly reduce the risk of theft and hacking.

Staying Informed

Stay informed about the latest developments in the crypto market and regulatory landscape. Changes in regulations or technological advancements can impact the value and security of your investments. Regularly monitoring news and market trends helps in making informed trading decisions.

Professional Advice

Consider seeking professional advice from financial advisors or insurance brokers specializing in the crypto industry. They can provide tailored recommendations based on your risk profile and help you navigate the complexities of crypto insurance.

Real-World Examples of Crypto Insurance in Action

Hacking Incidents

Several high-profile hacking incidents have underscored the importance of crypto insurance. For instance, the 2014 Mt. Gox hack resulted in the loss of approximately 850,000 Bitcoins. Such incidents have led to increased demand for insurance coverage to protect against similar losses.

Regulatory Compliance

Regulatory compliance is another area where insurance can play a critical role. For example, exchanges operating in jurisdictions with stringent regulations may face legal challenges. D&O insurance can provide a financial buffer for executives facing lawsuits related to regulatory compliance.

Operational Failures

Operational failures, such as system outages or technical glitches, can disrupt trading and lead to financial losses. Insurance coverage for operational risks ensures that traders and exchanges are protected against such unforeseen events.

Conclusion

As cryptocurrency trading continues to grow in popularity, the associated risks also increase. Insurance plays a pivotal role in mitigating these risks, providing a safety net for traders and exchanges alike. By understanding the various types of insurance coverage available, assessing the credibility of insurers, and implementing comprehensive risk management strategies, crypto traders can protect their investments and navigate the volatile market with greater confidence.